How Routine Testing Cut Fire Equipment Costs by 25%

—

THE $47,000 DISCOVERY

Manufacturing facility, 180 fire extinguishers, annual budget crisis.

Operations director reviewing three years of fire equipment expenses. Pattern emerged: costs increasing 12-18% annually despite consistent equipment quantity.

Annual fire equipment costs:

- Year 1: $8,200

- Year 2: $9,800 (+19.5%)

- Year 3: $11,400 (+16.3%)

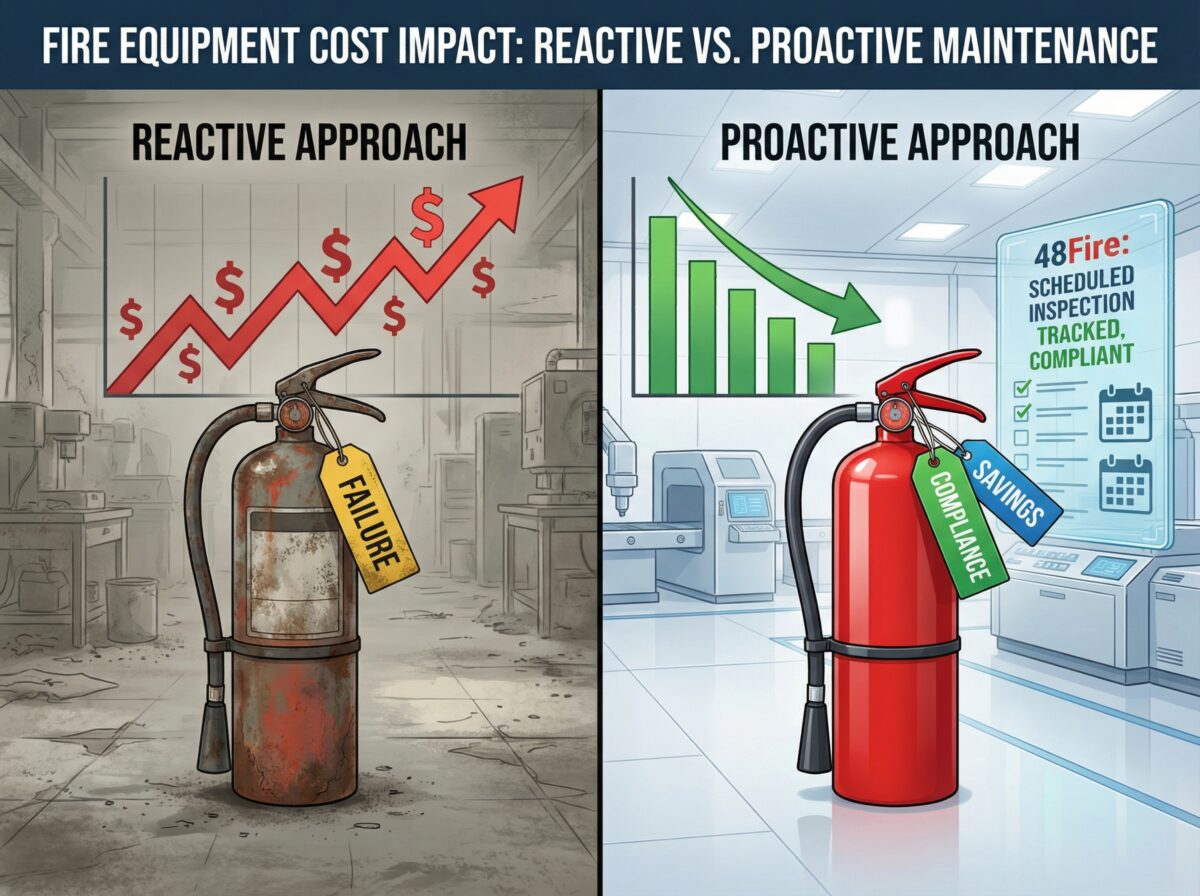

Investigation revealed the problem: reactive approach to annual fire inspection.

Equipment serviced only when obviously deficient. Testing postponed. Hydrostatic testing scheduled sporadically. Six-year examinations skipped.

Result: Equipment failures, emergency replacements, expedited service charges, regulatory violations, insurance complications.

After implementing systematic annual fire inspection program with 48Fire, three-year results:

Annual costs with routine testing:

- Year 4: $9,100 (-20.2%)

- Year 5: $8,600 (-5.5%)

- Year 6: $8,500 (-1.2%)

Three-year savings: $14,200

Cost reduction: 25.4%

This article explains how routine annual fire inspection reduces costs through early problem detection, equipment life extension, regulatory compliance, and insurance optimization.

—

UNDERSTANDING THE COST STRUCTURE

Total Fire Equipment Expenses

Complete annual costs include:

Routine service:

- Monthly or annual inspections

- Annual maintenance per NFPA 10 Section 7.3

- Six-year internal examinations per Section 7.3.1

- Hydrostatic testing per Section 8

Reactive corrections:

- Emergency replacements

- Expedited service charges

- Unscheduled repairs

- Temporary equipment rental

Regulatory compliance:

- Violation penalties

- Correction orders

- Follow-up inspection fees

- Third-party audits

Insurance impacts:

- Premium increases from deficiencies

- Claim complications

- Coverage limitations

- Deductible increases

Equipment replacement:

- Failed testing replacements

- Beyond-repair equipment

- Obsolete equipment updates

- Capacity additions

—

Reactive vs. Proactive Comparison

Typical 100-unit facility, 5-year analysis:

Reactive approach (minimal annual fire inspection):

| Year | Routine | Reactive | Regulatory | Insurance | Total |

|---|---|---|---|---|---|

| 1 | $4,000 | $2,800 | $0 | $0 | $6,800 |

| 2 | $4,200 | $3,400 | $0 | $1,200 | $8,800 |

| 3 | $4,400 | $4,100 | $5,000 | $2,400 | $15,900 |

| 4 | $4,600 | $3,800 | $1,000 | $2,400 | $11,800 |

| 5 | $4,800 | $4,200 | $0 | $2,400 | $11,400 |

| Total | $22,000 | $18,300 | $6,000 | $8,400 | $54,700 |

—

Proactive approach (systematic annual fire inspection):

| Year | Routine | Reactive | Regulatory | Insurance | Total |

|---|---|---|---|---|---|

| 1 | $5,500 | $800 | $0 | $0 | $6,300 |

| 2 | $5,600 | $600 | $0 | $0 | $6,200 |

| 3 | $5,700 | $900 | $0 | $0 | $6,600 |

| 4 | $5,800 | $700 | $0 | $0 | $6,500 |

| 5 | $5,900 | $800 | $0 | $0 | $6,700 |

| Total | $28,500 | $3,800 | $0 | $0 | $32,300 |

Savings: $22,400 (41% reduction)

Key insight: Higher routine annual fire inspection investment ($6,500 more) eliminates reactive costs ($14,500 savings), regulatory penalties ($6,000 savings), and insurance complications ($8,400 savings).

—

HOW ANNUAL FIRE INSPECTION REDUCES COSTS

Early Problem Detection

Without systematic annual fire inspection:

Equipment develops internal corrosion over years. External appearance acceptable. Visual inspections show no issues. Facility assumes equipment functional.

Hydrostatic testing finally required after 12 years. Testing reveals advanced internal corrosion. Unit fails per NFPA 10 Section 8.3.5.

Cost: Emergency replacement $180-350 per unit

—

With systematic annual fire inspection:

Six-year internal examination per NFPA 10 Section 7.3.1 detects early corrosion during annual fire inspection cycle. Surface rust identified before structural compromise. Enhanced maintenance corrects issue.

Equipment passes subsequent hydrostatic testing. Unit continues service 6+ additional years.

Cost: Enhanced maintenance $60-90 per unit

Savings per unit: $120-260

For 20 units: $2,400-5,200 total savings

—

Equipment Life Extension

Service life comparison from certified testing facilities:

Without systematic annual fire inspection:

- Average service life: 9-11 years

- Failure rate at first testing: 45-60%

- Primary failure cause: Undetected deterioration

- High emergency replacement rate

With systematic annual fire inspection:

- Average service life: 14-16 years

- Failure rate at first testing: 15-25%

- Failure prevention: Early detection and correction

- Planned replacement reducing costs

Service life extension: 5-7 years average

Cost impact (100-unit facility):

Without systematic inspection:

- Replace 45-60 units at year 12: $8,100-21,000

- Annual replacement cost: $675-1,750

With systematic annual fire inspection:

- Replace 15-25 units at year 12: $2,700-8,750

- Equipment serves additional 5-7 years

- Annual replacement cost: $193-625

Annual savings: $482-1,125

10-year savings: $4,820-11,250

—

Regulatory Compliance Maintenance

NFPA 10 testing requirements per Table 8.3.1:

| Type | Test Interval |

|---|---|

| CO2, water, foam, wet chemical | 5 years |

| Dry chemical (stored pressure) | 12 years |

Facilities without systematic annual fire inspection:

Equipment ages past testing deadlines. Fire marshal identifies overdue testing. Citations issued. Correction orders require immediate compliance.

Typical violation costs:

- Fire marshal citation: $500-2,000

- Emergency testing: $85-120 per unit (expedited)

- Failed unit replacements: $180-350 per unit

- Follow-up inspection: $250-500

- Management time: 20-40 hours

Total for 40 overdue units: $8,000-16,000

—

Facilities with systematic annual fire inspection:

48Fire tracks equipment ages automatically. Testing scheduled before deadlines. All testing current when inspectors review. No violations cited.

Compliance cost:

- Scheduled testing: $50-75 per unit (standard)

- Failed unit replacements: $180-350 per unit

- No penalties, no expedited charges

- Minimal management time

Total for 40 units on schedule: $5,000-8,000

Savings: $3,000-8,000 per testing cycle

—

Insurance Premium Optimization

Impact of annual fire inspection on insurance:

Case study: Office complex, $2M property coverage

Before systematic inspection:

Insurance carrier assessment identified:

- Fire extinguisher testing significantly overdue

- Compliance status uncertain

- Maintenance documentation incomplete

- Fire protection reliability questionable

Premium impact:

- Base premium: $18,000

- Fire protection deficiency surcharge: +25%

- Total annual premium: $22,500

—

After systematic annual fire inspection:

Risk reassessment following one year of 48Fire systematic program:

- All testing current per NFPA requirements

- Complete compliance documentation

- Professional certified service verified

- Fire protection reliability demonstrated

Premium impact:

- Base premium: $18,000

- Fire protection compliance credit: -8%

- Total annual premium: $16,560

Annual savings: $5,940

5-year savings: $29,700

—

THE INSPECTION INVESTMENT BREAKDOWN

Actual Annual Fire Inspection Costs

Systematic program expenses (100-unit facility):

Hydrostatic testing (12-year interval):

- Testing service: $50-75 per unit

- Recharge after passing: $35-50 per unit

- Replacement if failed: $180-350 per unit (20% typical)

- Transport and coordination included

Annual average cost:

- 8-9 units tested annually: $680-1,125

- Replacements (20% rate): $290-630

- Total annual testing: $970-1,755

Six-year internal examination:

- Examination service: $60-90 per unit

- 17 units examined annually: $1,020-1,530

Total annual fire inspection investment:

- Testing program: $970-1,755

- Six-year examinations: $1,020-1,530

- Combined: $1,990-3,285

—

Return on Investment

Cost avoidance from systematic annual fire inspection:

Emergency replacement prevention:

- Without inspection: 45-60% failure = 45-60 emergencies

- With inspection: 20% failure = 20 planned replacements

- Avoided emergencies: 25-40 units

- Emergency premium: $50-100 per unit

- Savings: $1,250-4,000

Regulatory violation prevention:

- Typical violation cost: $8,000-16,000

- Probability without inspection: 60-80% over 5 years

- Expected violation cost: $4,800-12,800

- Violations with systematic inspection: Near zero

- Savings: $4,800-12,800

Insurance premium optimization:

- Annual premium reduction: $2,000-6,000

- 5-year savings: $10,000-30,000

Equipment life extension:

- Extended service: 5-7 years

- Delayed replacement savings: $4,820-11,250 over 10 years

- Annual benefit: $482-1,125

Total annual cost avoidance: $7,332-18,925

Annual fire inspection investment: $1,990-3,285

Net annual benefit: $5,342-15,640

ROI: 168-576%

—

REAL FACILITY COST REDUCTIONS

Case Study 1: Manufacturing Facility

Profile:

- 180 fire extinguishers

- Mixed types (dry chemical, CO2, wet chemical)

- Equipment ages: 4-18 years

- Previous approach: Reactive service only

Problem:

- Escalating annual costs

- Frequent emergency replacements

- Fire marshal compliance issues

- Insurance complications

Implementation:

Comprehensive annual fire inspection program with 48Fire:

- Complete equipment age audit

- Systematic testing schedule

- Six-year examination program

- Digital tracking and automated scheduling

—

Year 1 results:

Initial investment higher (catching up overdue testing):

- Hydrostatic testing backlog: 48 units

- Six-year examination backlog: 62 units

- Failed unit replacements: 19 units

- Total Year 1: $13,200

Years 2-3 results:

Ongoing systematic annual fire inspection:

- Annual testing (scheduled): 15 units

- Six-year examinations: 30 units annually

- Failed replacements: 3-4 units annually

- Annual cost stabilized: $8,500-9,100

Cost reduction:

- Pre-implementation average: $11,400

- Post-implementation average: $8,800

- Annual savings: $2,600

- Percentage reduction: 22.8%

- Three-year savings: $7,800

Additional benefits:

- Fire marshal compliance verified

- Insurance premium reduced 15%

- Zero emergency replacements

- Predictable budget

—

Case Study 2: Office Complex

Profile:

- 120 fire extinguishers

- Primarily dry chemical

- Equipment ages: 6-15 years

- Previous approach: Annual maintenance only, no systematic testing

Problem:

- Fire marshal identified 28 units overdue

- Citation issued with 60-day correction

- Emergency testing required

- Equipment condition uncertain

Implementation:

Emergency correction followed by systematic annual fire inspection:

- Immediate testing program: 28 overdue units

- Complete facility audit

- Systematic schedule established with 48Fire

- Ongoing program preventing future violations

—

Emergency correction costs (Year 1):

- Expedited testing: 28 units @ $95-120 = $2,660-3,360

- Failed replacements: 12 units @ $200-320 = $2,400-3,840

- Citation penalty: $1,200

- Follow-up inspection: $350

- Total Year 1: $6,610-8,750

Ongoing program (Years 2-4):

- Annual testing (scheduled): 10 units

- Six-year examinations: 20 units annually

- Failed replacements: 2 units annually

- Annual cost: $2,100-2,800

Cost comparison:

- Pre-implementation reactive: $3,800-5,200 annually

- Systematic annual fire inspection: $2,100-2,800 annually

- Annual savings: $1,700-2,400

- Percentage reduction: 31-46%

—

Case Study 3: Distribution Center

Profile:

- 240 fire extinguishers

- Large facility, multiple buildings

- Equipment ages: 2-20 years

- Previous approach: Inconsistent service

Challenge:

- Insurance carrier identified deficiencies during renewal

- Premium increase 28% due to compliance concerns

- Required systematic annual fire inspection for coverage

- Significant overdue testing identified

Implementation:

Comprehensive program with 48Fire:

- Complete equipment assessment

- Multi-phase testing program

- Systematic ongoing inspection

- Digital documentation for insurance verification

—

Phase 1 (Year 1):

- Critical testing (15+ years): 60 units

- Failed replacements: 32 units

- Investment: $9,800

Phase 2 (Year 2):

- Remaining overdue testing: 48 units

- Six-year examinations begin: 40 units

- Failed replacements: 14 units

- Investment: $8,200

Phase 3 (Year 3+):

- Routine testing: 20 units annually

- Six-year examinations: 40 units annually

- Failed replacements: 4-5 units annually

- Annual cost stabilized: $7,400-8,100

Results:

Cost reduction:

- Pre-implementation: $15,200

- Post-implementation average: $7,750

- Annual savings: $7,450

- Percentage reduction: 49%

Insurance impact:

- Premium increase reversed after Year 2

- Premium decreased 12% below original

- Annual insurance savings: $4,800

- Combined annual benefit: $12,250

Total three-year savings: $36,750

—

IMPLEMENTING SYSTEMATIC ANNUAL FIRE INSPECTION

Assessment Phase

Step 1: Complete equipment audit

48Fire comprehensive assessment:

- Equipment inventory (types, quantities, locations)

- Manufacturing date documentation

- Last testing date verification

- Service history review

- Compliance gap identification

Deliverable: Complete equipment profile with testing schedule

—

Step 2: Testing backlog identification

Analysis determines:

- Units overdue for hydrostatic testing

- Six-year examinations never performed

- Equipment approaching testing deadlines

- Regulatory compliance status

Deliverable: Prioritized schedule with budget projection

—

Implementation Phase

Step 3: Program execution

Systematic annual fire inspection implementation:

Option A: Immediate full compliance

- Test all overdue equipment immediately

- Higher Year 1 cost

- Complete compliance achieved quickly

- Suitable for regulatory pressure

Option B: Phased approach

- Prioritize critical/oldest equipment

- Spread costs across 18-24 months

- Gradual compliance achievement

- Suitable for budget constraints

48Fire accommodates either approach.

—

Step 4: Ongoing schedule establishment

Systematic annual fire inspection includes:

- Automated testing deadline tracking

- Advanced scheduling (6-12 months notice)

- Budget forecasting

- Temporary equipment during testing

- Complete documentation maintenance

—

Maintenance Phase

Step 5: Continuous compliance

Systematic annual fire inspection maintenance:

Automated scheduling:

- System calculates testing due dates

- Notifications 6-12 months before deadlines

- Coordination with facility schedules

- No missed deadlines

Budget predictability:

- Annual testing quantity projected

- Replacement rate estimated

- Costs forecast for planning

- No emergency surprises

Documentation maintenance:

- Complete testing history preserved

- Regulatory compliance verified

- Insurance requirements satisfied

- Audit-ready records accessible

—

MEASURING YOUR SAVINGS

Cost Tracking Methodology

Establish baseline:

Year before systematic annual fire inspection:

- Total service costs

- Emergency replacements

- Regulatory violations/corrections

- Insurance premiums (fire protection component)

Track ongoing costs:

Each year with systematic annual fire inspection:

- Routine testing costs

- Scheduled replacements

- Regulatory compliance costs

- Insurance premiums

Calculate savings:

- Baseline cost vs. current year cost

- Annual savings

- Percentage reduction

—

Expected Savings Timeline

Typical annual fire inspection financial impact:

Year 1:

- Higher investment (catching up overdue testing)

- Savings beginning (emergency elimination, violation prevention)

- Net impact: -10% to +15% depending on backlog

Year 2:

- Ongoing program costs normalized

- Full savings realized (insurance, compliance, emergencies)

- Net savings: 15-25%

Year 3+:

- Equipment life extension benefits emerging

- Replacement timing optimized

- Net savings: 20-30%

5-year cumulative:

- Total savings: 25-35% compared to reactive approach

- ROI on inspection investment: 200-500%

—

CONCLUSION

Routine annual fire inspection reduces costs through:

Early problem detection: Issues identified before failure, preventing emergency replacements (savings: $1,250-4,000 annually)

Equipment life extension: Service life increased 5-7 years through early correction (savings: $482-1,125 annually)

Regulatory compliance maintenance: Violation prevention eliminating penalties and correction costs (savings: $4,800-12,800 per violation avoided)

Insurance optimization: Premium reductions from demonstrated reliability (savings: $2,000-6,000 annually)

Total cost reduction: 25-35% over 5 years compared to reactive approach

Systematic annual fire inspection investment:

- Annual cost: $1,990-3,285 for 100-unit facility

- Annual savings: $7,332-18,925

- Net annual benefit: $5,342-15,640

- ROI: 168-576%

Case study results:

- Manufacturing facility: 22.8% cost reduction ($7,800 three-year savings)

- Office complex: 31-46% cost reduction

- Distribution center: 49% cost reduction ($36,750 three-year savings)

48Fire systematic annual fire inspection programs provide complete NFPA compliance, automated scheduling, predictable budgeting, and documented cost reduction—helping facilities achieve 25%+ savings while improving fire protection reliability.

[Implement Systematic Annual Fire Inspection](/contact-us)

—

48Fire

Annual Fire Inspection Programs

Systematic Scheduling • Cost Reduction • NFPA Compliance

Contact: [/contact-us](/contact-us)