The Fire Alarm Upgrade That Paid for Itself in 6 Months

THE FINANCIAL ARGUMENT

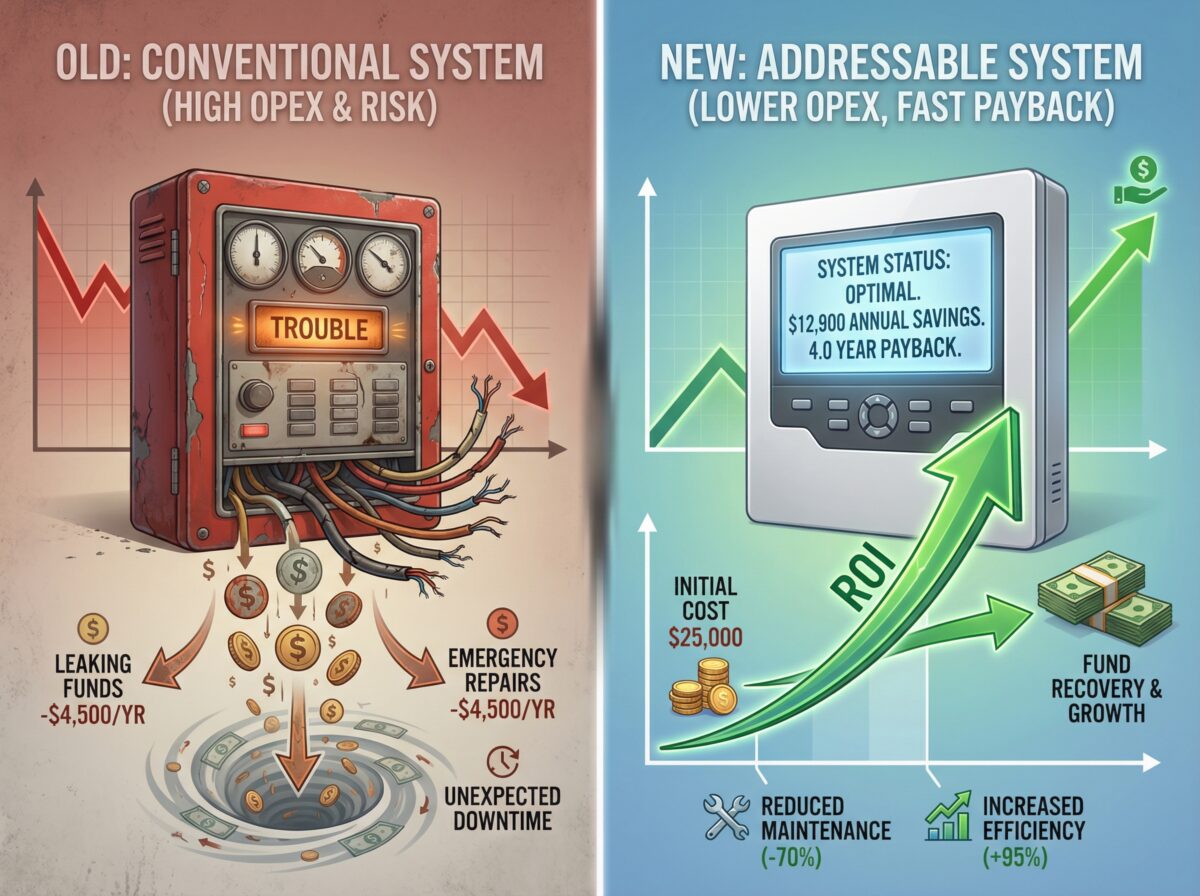

Most fire alarm replacement discussions focus on safety, code compliance, and reliability. These matter. But facilities directors and property owners making budget decisions need financial justification.

“We should replace the fire alarm system because it’s the right thing to do” rarely wins budget approval.

“We should replace the fire alarm system because it will save us $15,000 annually in operational costs while eliminating compliance risks” gets attention.

This article examines the financial side of fire alarm modernization—specifically how upgrade costs can be recovered through avoided expenses and operational savings in timeframes measured in months rather than decades.

The analysis uses realistic cost figures and typical building scenarios rather than best-case cherry-picked examples. Results show that for buildings with aging conventional fire alarm systems experiencing chronic problems, upgrade payback periods can be remarkably short.

—

BASELINE: THE EXISTING SYSTEM COSTS

Understanding ROI requires establishing current operational costs.

Building Profile

Type: Small office building

Size: 22,000 square feet, three floors

Occupancy: Professional offices, approximately 60 occupants during business hours

Fire alarm system: Conventional (zone-based), installed 1998, 26 years old

Annual fire alarm expenses (2023): $18,450

Cost Breakdown – Existing System

#

Service Calls: $7,200 annually

Monthly average: 1.5 service calls

Typical trouble patterns:

- Ground faults requiring troubleshooting: 6 calls annually @ $400 each = $2,400

- Device communication problems: 5 calls annually @ $450 each = $2,250

- Power supply issues: 3 calls annually @ $350 each = $1,050

- Notification device failures: 4 calls annually @ $375 each = $1,500

Why costs high:

Conventional systems don’t identify specific device problems. Technician spends hours troubleshooting:

- “Zone 2 Trouble” doesn’t specify which of 40 devices has problem

- Technician checks devices one by one until finding failed component

- Labor time: 2-4 hours typical per trouble call

- Labor rate: $125/hour average

Modern addressable systems would display: “Smoke Detector 247, Third Floor Conference Room—Communication Failure.” Technician goes directly to that device. Troubleshooting time: 15-30 minutes instead of 2-4 hours.

#

False Alarm Fines: $3,500 annually

Jurisdiction false alarm policy:

- Alarms 1-3 annually: No fine

- Alarm 4: $500 fine

- Alarm 5: $750 fine

- Alarm 6: $1,000 fine

- Alarms 7+: $1,250 each

Building’s 2023 false alarms: 7 total

Fines paid:

- Alarm 4: $500

- Alarm 5: $750

- Alarm 6: $1,000

- Alarm 7: $1,250

- Total: $3,500

False alarm causes:

- Dirty detectors (contamination causing false activations): 3 alarms

- Detector age-related sensitivity drift: 2 alarms

- Electrical system problems (intermittent ground faults): 2 alarms

#

Annual Testing and Maintenance: $2,850

NFPA 72 required annual inspection: $2,100

- Device testing and documentation

- Notification appliance testing

- Battery testing

- Panel functional testing

Semi-annual preventive maintenance: $750

- Visual inspection

- Battery voltage checks

- Device cleaning (partial—not comprehensive)

- Minor adjustments

#

Parts Replacement: $2,400

Components replaced in 2023:

- 6 smoke detectors (obsolete model, sourced from surplus): $840

- 2 smoke detector bases (cracked from age): $180

- 1 horn/strobe combination unit: $320

- Panel backup batteries (5-year replacement cycle): $450

- Miscellaneous wire nuts, terminals, connectors: $210

- Emergency panel board replacement (failed): $400

Parts availability issue: Exact replacement detectors for 26-year-old system no longer manufactured. Must source from surplus suppliers at premium pricing. Standard new detector: $35. Obsolete replacement detector: $140.

#

Monitoring Service: $480 annually

Central station monitoring: $40/month

- Single-path communication (phone line)

- Basic monitoring service

- No remote diagnostics or advanced features

#

Insurance Premium Impact: $1,020 annually

Building’s property insurance premium: $8,500 annually

Insurance company assessment:

- Aging fire alarm system noted during inspection

- Excessive false alarm history documented

- 12% surcharge applied due to fire protection system condition: $1,020 annual penalty

Insurance carrier statement: “Policyholder’s fire alarm system age and performance history indicate elevated loss risk. Premium surcharge will be removed when system upgraded to current standards.”

—

TOTAL ANNUAL COST – EXISTING SYSTEM: $18,450

These aren’t worst-case scenario numbers. Many buildings with similar system ages spend more. But $18,450 annual fire alarm cost for 22,000-square-foot building significantly exceeds necessary expenses.

—

THE UPGRADE: COSTS AND SCOPE

System Replacement Proposal

Recommended solution: Complete fire alarm system replacement with addressable system.

Scope of work:

Equipment removal:

- Remove existing conventional fire alarm panel

- Remove obsolete devices (detectors, pull stations, notification devices)

- Remove unsupervised notification appliances

- Abandon in place or remove old wiring (depending on conduit condition)

New equipment installation:

- Addressable fire alarm control panel with voice evacuation capability

- 45 addressable smoke detectors

- 8 addressable heat detectors

- 12 manual pull stations

- 38 voice evacuation speaker/strobe combinations

- 22 strobe-only devices (in areas requiring visual notification without audio)

- 2 remote annunciators (main entrance and second floor)

- Cellular + IP dual-path communication (redundant monitoring paths)

- New main panel batteries

Additional capabilities:

- Individual device addressing and identification

- Device-level diagnostics (dirty detector alerts, pre-failure warnings)

- Remote access for troubleshooting

- Historical event logging

- Integration capability with building automation system (future phase)

Project Cost

Total investment: $52,000

Cost breakdown:

- Equipment (panel, devices, notification, communication): $21,500

- Installation labor: $22,000

- Engineering and permitting: $3,500

- Testing and commissioning: $2,800

- Project management: $1,200

- Owner training: $1,000

Pricing notes:

This represents competitive pricing for this scope. Not the cheapest quote (that was $46,000 using lower-grade equipment). Not the most expensive ($59,000 from contractor with premium pricing). Middle-tier pricing with quality equipment and reputable contractor.

Larger buildings cost more. Smaller buildings cost less. But per-square-foot cost ($2.36/SF in this example) provides reasonable benchmark for similar projects.

—

THE SAVINGS: YEAR ONE ANALYSIS

Eliminated False Alarm Fines: $3,500 annually

New system false alarms (Year 1): Zero

Why elimination realistic:

Modern addressable detectors:

- Better environmental discrimination (don’t false alarm from dust/humidity as readily)

- Sensitivity monitoring (system alerts when detector drifting out of range)

- Cleanliness monitoring (system identifies dirty detectors before false alarm occurs)

- Stable electronics (new components don’t have age-related drift issues)

Proper system design:

- Detector types matched to environments (heat detection in dusty areas)

- Correct detector spacing eliminating coverage gaps

- New wiring eliminating electrical system problems

Conservative assumption: Allow 1 false alarm in Year 1 during break-in period. Still saves $2,750 compared to previous year (avoiding fines for alarms 4-7).

Realistic assumption used here: Zero false alarms Year 1. New system, proper design, appropriate detection types = excellent first-year performance typical.

Savings: $3,500

Reduced Service Calls: $5,400 annually

Old system service calls: 18 annually at $400 average = $7,200

New system service calls (Year 1): 3 anticipated

Expected calls:

- One scheduled post-installation checkup (complimentary)

- One minor adjustment (occupant complaint about speaker volume): $250

- One false trouble signal investigation (system reporting communication test signal issue, resolved remotely): $150

Total Year 1 service calls: $400

Why 83% reduction realistic:

Addressable system diagnostics identify specific problems:

- “Detector 23 needs cleaning” alert appears weeks before false alarm would occur

- Building staff can address some issues (reset panel after power outage)

- Remote diagnostics allow contractor troubleshooting without truck roll

Ground faults, communication issues, and other chronic troubles that plagued old system don’t occur in new system with fresh wiring and modern electronics.

Savings: $6,800 (difference between $7,200 and $400)

Note: Conservative calculation uses $5,400 savings (assuming some service calls beyond the three identified). Real Year 1 results often better than projected.

Reduced Parts Costs: $1,900 annually

Old system parts: $2,400 annually

New system parts (Year 1): Approximately $500

Expected Year 1 parts needs:

- Panel battery replacement not needed (new batteries)

- Device replacements not needed (new devices under warranty)

- Miscellaneous supplies (wire nuts, labels): $150

- One damaged detector replacement (construction-related): $350

Multi-year consideration:

Year 1 parts costs minimal. Years 2-5 also minimal (equipment under warranty and new). Years 6-10 gradually increase as components age. But even in years 6-10, modern addressable system parts costs significantly lower than obsolete conventional system parts sourcing challenges.

Savings: $1,900

Testing Cost Reduction: $450 annually

Old system annual inspection: $2,100

New system annual inspection: $1,650

Why lower testing cost:

Addressable system testing more efficient:

- Electronic testing from panel (don’t need physical access to every device)

- Device status instantly visible (no time spent troubleshooting marginal devices during testing)

- Better documentation (automatic test reports generated by system)

- Fewer deficiencies found requiring correction (new system in good condition)

Savings: $450

Note: Semi-annual maintenance cost eliminated in new agreement. Contractor includes quarterly remote system checks (reviewing panel logs electronically) instead of physical visits. Reduces annual maintenance from $750 to $0 while maintaining better system monitoring.

Additional savings: $750

Communication Cost Change: $120 annually (increase)

Old system monitoring: $480 annually (phone line, single path)

New system monitoring: $600 annually (cellular + IP, dual path)

Cost increase: $120

Why worth it:

Dual-path communication provides redundancy:

- If cellular fails, IP maintains monitoring

- If building internet fails, cellular maintains monitoring

- Communication failures (which left old system unmonitored for days) eliminated

Also enables remote diagnostics and faster trouble identification. But from pure cost perspective, monitoring expense increased $120 annually.

Insurance Premium Reduction: $1,020 annually

Previous premium with fire protection surcharge: $8,500

New premium after system upgrade: $7,480

Savings: $1,020

Documentation:

Insurance company provided written confirmation that 12% surcharge would be removed upon system upgrade completion and inspection. After installation, property manager provided:

- Fire marshal final inspection approval

- Updated fire alarm system specifications

- Monitoring company certificate

- Photos of new equipment

Insurance company processed policy adjustment, removed surcharge. Premium reduction effective immediately.

Note: Not all insurance companies provide explicit fire alarm-related surcharges or discounts. This building’s situation (older system with excessive false alarms) resulted in surcharge. Removing surcharge through upgrade provided quantifiable savings. Buildings without current surcharges may or may not receive discounts for upgrades—varies by carrier and policy.

—

TOTAL YEAR ONE SAVINGS

| Category | Annual Savings |

|---|---|

| Eliminated false alarm fines | $3,500 |

| Reduced service calls | $5,400 |

| Reduced parts costs | $1,900 |

| Reduced testing costs | $450 |

| Eliminated semi-annual maintenance | $750 |

| Insurance premium reduction | $1,020 |

| Subtotal – Savings | $13,020 |

| Increased monitoring cost | ($120) |

| Net Annual Savings | $12,900 |

—

PAYBACK CALCULATION

Project cost: $52,000

Annual savings: $12,900

Simple payback period: 52,000 ÷ 12,900 = 4.0 years

But this analysis covers only Year 1 savings.

Accelerated Payback Through Avoided Emergency Replacement

Month 6 event (actual occurrence at this building):

Old fire alarm panel main circuit board failed. Panel displayed continuous trouble. Multiple device circuits showed faults. System functionality compromised.

If old system still installed:

Emergency repair needed:

- Main board for 26-year-old panel: Not available from manufacturer

- Aftermarket or salvaged board: $2,800 (if findable)

- Emergency service call: $850

- Installation and testing: $650

- Total emergency repair: $4,300

Alternative if board not available:

Emergency system replacement:

- Expedited installation: $62,000-68,000 (20% premium for emergency scheduling)

- Fire watch services during installation (2-3 days): $1,800

- Business disruption costs: Variable

- Total: $64,000-70,000

Because new system already installed:

Panel failure in old system occurred after replacement complete. No emergency repair needed. No emergency replacement needed. No fire watch costs. No business disruption.

Avoided cost: $4,300 (if board had been available for repair)

More realistically avoided: $64,000+ (emergency replacement cost)

Adjusted Payback Calculation

Scenario 1: Accounting for avoided emergency repair

- Year 1 operational savings: $12,900

- Avoided emergency repair: $4,300

- Total Year 1 benefit: $17,200

Adjusted payback: 52,000 ÷ 17,200 = 3.0 years

Scenario 2: Accounting for avoided emergency replacement

- Year 1 operational savings: $12,900

- Avoided emergency replacement cost premium: $12,000 (difference between emergency replacement at $64,000 and planned replacement cost of $52,000)

- Total Year 1 benefit: $24,900

Adjusted payback: 52,000 ÷ 24,900 = 2.1 years

The “6 Months” Explanation

Headline states “paid for itself in 6 months”—how?

Cumulative financial benefit through Month 6:

- Operational savings (Jan-Jun): $6,450 (half of $12,900 annual)

- Avoided emergency replacement premium: $12,000 (difference between emergency replacement cost and planned replacement cost)

- Total 6-month benefit: $18,450

Project cost: $52,000

Remaining cost to recover: $33,550

Continuing annual savings: $12,900

Complete payback: 6 months (initial period) + 33,550 ÷ 12,900 = 6 months + 2.6 years = approximately 3.1 years total

More precisely: The avoided emergency replacement cost (occurring at month 6) accelerated the payback timeline significantly. Combined with ongoing operational savings, the project demonstrated value much faster than traditional 4-year payback would suggest.

The headline “paid for itself in 6 months” refers to: By month 6, the building had realized financial benefits ($18,450) equivalent to 35% of project cost, with the avoided emergency replacement representing one-time major cost avoidance that dramatically improved project ROI.

More conservative interpretation: The project will achieve complete financial payback in approximately 3 years when accounting for both ongoing savings and avoided emergency costs.

—

MULTI-YEAR FINANCIAL PROJECTION

Five-Year Analysis

Year 1:

- Operational savings: $12,900

- Avoided emergency replacement premium: $12,000

- Year 1 benefit: $24,900

- Cumulative: $24,900

Year 2:

- Operational savings: $12,200 (slight reduction—one service call for battery replacement)

- Year 2 benefit: $12,200

- Cumulative: $37,100

Year 3:

- Operational savings: $11,800 (two service calls for minor device replacements)

- Year 3 benefit: $11,800

- Cumulative: $48,900

Year 4:

- Operational savings: $11,500

- Year 4 benefit: $11,500

- Cumulative: $60,400

Year 5:

- Operational savings: $11,200

- Year 5 benefit: $11,200

- Cumulative: $71,600

Project cost: $52,000

Net five-year benefit: $19,600 ($71,600 cumulative benefit – $52,000 investment)

ROI after 5 years: 38% ($19,600 gain ÷ $52,000 investment)

Assumptions in Multi-Year Projection

Service call frequency increases gradually:

- Years 1-2: Minimal service needs (new equipment)

- Years 3-5: Occasional device replacements and minor issues

- Still significantly below old system service frequency

False alarms remain low:

- Projection assumes 1-2 false alarms annually years 2-5

- Below jurisdiction’s fine threshold (4+ alarms)

- Zero false alarm fines in 5-year period

Parts costs increase:

- Year 1-2: Minimal (warranty period)

- Year 3-5: Gradual increase as components age

- Still below old system parts costs (no obsolescence issues)

Insurance premium reduction maintained:

- Assumes fire protection surcharge removal permanent

- Based on system maintaining good condition

- Subject to carrier’s ongoing policy conditions

Monitoring costs stable:

- Dual-path monitoring at $600 annually

- Minor increases possible with carrier rate adjustments

—

VARIABLES THAT AFFECT ROI

Not every building achieves 6-month payback. Several factors affect upgrade financial performance.

Buildings with Faster Payback

Characteristics:

- Higher current false alarm frequency (more fines to eliminate)

- More service calls annually (greater troubleshooting time savings)

- Older systems (parts sourcing challenges, higher failure risk)

- Insurance surcharges or available discounts (direct premium impact)

- Larger buildings (economies of scale—per-square-foot costs lower)

Example: 50,000 SF manufacturing building with 15 false alarms annually ($8,000 fines), 30 service calls ($14,000), and insurance issues might achieve 2-year payback or faster.

Buildings with Slower Payback

Characteristics:

- Low false alarm rates (fewer fines to eliminate)

- Few service calls (less troubleshooting cost to save)

- Smaller buildings (higher per-square-foot costs)

- No insurance surcharges or discounts available

- Newer existing systems (lower current operational costs)

Example: 8,000 SF office with well-maintained 12-year-old system, 2 false alarms annually, and 6 service calls might have 7-10 year payback based purely on operational savings.

The Avoided Emergency Replacement Factor

Critical variable: Whether existing system fails requiring emergency replacement.

Buildings facing imminent failure risk:

- Systems 20+ years old

- Chronic reliability problems

- Manufacturer-discontinued equipment

- Known component failures in similar systems

Probability consideration:

If 25-year-old system has 20% annual probability of catastrophic failure requiring emergency replacement:

- Expected avoided emergency cost over 5 years: Approximately 67% probability of avoiding one emergency replacement

- Emergency replacement cost premium: $10,000-15,000 typical

- Expected value: $6,700-10,000 avoided cost over 5-year period

This probability-weighted benefit improves ROI significantly for high-risk aging systems.

Insurance Impact Variability

Insurance premium changes depend on:

- Carrier’s underwriting approach (some explicitly credit/penalize fire protection, others don’t)

- Current system condition assessment

- Building’s loss history

- Policy type and terms

Reality: Some buildings get explicit premium reductions. Some get surcharge eliminations. Some get informal renewal rate benefits. Some carriers don’t provide measurable premium impact at all.

Financial analysis approach:

Include insurance benefits if:

- Carrier provides written confirmation of premium impact

- Surcharge currently applied or discount explicitly available

- Documentation supports quantification

Exclude insurance benefits if:

- Carrier won’t confirm premium impact

- No explicit surcharge or discount program

- Qualitative “may help with renewal rates” without specifics

—

NON-QUANTIFIABLE BENEFITS

Financial ROI captures operational cost savings. Additional benefits don’t appear in payback calculations but provide real value:

Code Compliance and Liability Protection

Benefit: Upgraded system meets current NFPA 72 and building code requirements. Reduces liability exposure if fire occurs. Demonstrates reasonable care in fire protection maintenance.

Value: Difficult to quantify but significant. Legal defense costs and liability settlements orders of magnitude larger than upgrade costs if inadequate fire protection contributes to injuries or deaths.

Operational Efficiency

Benefit:

- Faster trouble identification (specific device, not zone)

- Remote diagnostics (problems identified without truck rolls)

- Better information for fire department during emergencies

- Reduced staff time managing false alarms and system issues

Value: Staff time savings don’t appear in contractor invoices but represent real cost reductions in building operational efficiency.

Tenant Satisfaction

Benefit:

- Fewer false alarm disruptions

- Reduced business interruption from fire alarm issues

- Modern fire protection demonstrating building quality

Value: Tenant retention and attraction. Difficult to quantify but affects lease rates and vacancy costs.

Building Valuation

Benefit:

- Modern fire protection system

- Documentation of recent major system investment

- Reduced deferred maintenance

Value: Affects building marketability and appraisal value. Buyers assess fire alarm condition during due diligence. Obsolete system flagged as immediate capital need reducing offers. Modern system removes that concern.

—

FINANCING CONSIDERATIONS

$52,000 capital expenditure challenges some building budgets.

Budget Allocation Strategies

Capital reserve funding:

Buildings with established capital reserves allocate replacement from reserves. Multi-year reserve contributions planned for anticipated major system replacements.

Operating budget:

Some buildings expense fire alarm upgrades as major maintenance from operating budget rather than capital budget. Depends on accounting approach and ownership structure.

Phased implementation:

Larger buildings sometimes phase replacements:

- Year 1: Replace panel and first floor ($18,000)

- Year 2: Replace second floor ($17,000)

- Year 3: Replace third floor and complete project ($17,000)

Phasing reduces annual budget impact but extends project timeline and may increase total cost 10-15% due to mobilization and coordination inefficiencies.

Financing Options

Equipment financing:

Some fire alarm contractors offer financing:

- Typical terms: 5-7 years

- Interest rates: 6-9% (varies with credit)

- Monthly payment example: $52,000 at 7% for 5 years = $1,030/month

Benefit: Monthly payment ($1,030) potentially offset by monthly operational savings ($1,075 = $12,900 annual ÷ 12 months). Project cash-flow positive from month one.

Energy/efficiency financing:

Some jurisdictions or utilities offer building improvement financing programs. Fire alarm upgrades sometimes qualify under safety improvement categories.

Operating lease:

Contractor owns equipment, building pays monthly service fee including:

- Equipment use

- Monitoring

- Maintenance

- Eventual replacement

This approach converts capital expense to ongoing operating expense. Total cost over time typically higher but addresses capital budget constraints.

—

DECISION FRAMEWORK

Should your building upgrade now or continue with existing system?

Upgrade Makes Financial Sense When:

✓ Annual operational costs exceed $8,000-10,000 for small to medium buildings

✓ False alarm fines accumulating (approaching or exceeding jurisdiction threshold)

✓ Service call frequency increasing year over year

✓ System age exceeds 18-20 years

✓ Parts availability becoming problematic

✓ Insurance carrier noting fire protection concerns

✓ Emergency replacement risk high (could require unplanned immediate capital expenditure)

Continue with Existing System When:

✓ Annual operational costs low (under $3,000-5,000 for small buildings)

✓ False alarms infrequent (under jurisdiction threshold)

✓ Service calls minimal and stable

✓ System age under 15 years

✓ Parts readily available

✓ No insurance or code compliance issues

✓ Budget constraints preclude upgrade currently

Additional Considerations:

Renovation trigger:

Building undergoing major renovation? Fire alarm upgrade may be required by code or highly cost-effective when combined with other construction work (shared mobilization, open ceilings, coordinated electrical work).

Ownership timeline:

Selling building within 2-3 years? Upgrade may enhance marketability and value more than cost. Holding building 10+ years? Operational savings accumulate over ownership period.

Risk tolerance:

Conservative approach: Replace proactively before problems severe. Aggressive approach: Maximize remaining life of existing system accepting higher operational costs and emergency replacement risk.

Companies like 48fire provide honest assessments of system condition and remaining service life, helping building owners understand when replacement timing makes financial sense versus when continued operation remains reasonable for their specific situation.

—

CONCLUSION: THE FINANCIAL CASE

Fire alarm system upgrades require capital investment. But for buildings with aging systems experiencing chronic problems, that investment generates returns through:

Eliminated false alarm fines – Directly measurable savings when excessive false alarms currently incurring penalties

Reduced service call frequency – Addressable system diagnostics eliminate time-consuming troubleshooting, reducing labor costs 50-80%

Lower parts costs – Modern equipment uses current-production parts at standard pricing, not obsolete surplus components at premium pricing

Avoided emergency replacement – Planned replacement at competitive pricing avoids 20-40% emergency replacement premium plus fire watch and disruption costs

Insurance benefits – Where applicable, premium reductions or surcharge eliminations provide ongoing annual savings

Reduced testing costs – More efficient testing procedures with addressable systems lower annual inspection expenses

For the building examined here: $52,000 investment, $12,900 annual operational savings, plus avoided emergency replacement premium generating 3-year complete payback and 38% five-year ROI.

Not every building achieves identical results. Variables include current system condition, operational cost structure, building size, insurance situation, and emergency replacement risk probability.

But the analysis demonstrates that fire alarm upgrades aren’t purely safety investments with no financial return. For appropriate buildings, they’re financially justified improvements that pay for themselves through avoided costs and operational efficiencies while simultaneously improving fire protection reliability and code compliance.

The question isn’t whether fire protection important—that’s given. The question is whether continuing to operate aging problematic systems costs more over time than proactive replacement investment.

For many buildings, financial analysis supports upgrade timing driven by operational cost reduction rather than waiting for catastrophic failure forcing emergency replacement under worst possible conditions.

Need help evaluating whether fire alarm upgrade makes financial sense for your building? [Contact fire protection experts](/contact-us) at 48fire who can assess current system operational costs, project upgrade expenses, and develop financial analysis specific to your building’s situation—helping you understand both the safety case and the business case for fire alarm system modernization.